Why U.S. expatriates in Spain should carefully assess their foreign tax credits in Spanish income tax returns (IRPF)

On January 28, 2025, the Tribunal Económico-Administrativo Regional (TEAR) of Madrid issued a significant decision regarding the interpretation of Article 80 of the Spanish Personal Income Tax Act (LIRPF), specifically concerning the deduction for international double taxation (deducción por doble imposición internacional). The case revolved around a U.S. expatriate taxpayer who included over €470,000 as a deduction in their IRPF return for taxes paid abroad, including both federal and state/local taxes in the United States.

However, the Spanish Tax Agency (Agencia Tributaria) adjusted the return and limited the deduction strictly to federal taxes, excluding state and local taxes. This adjustment was made in accordance with the U.S.–Spain Double Taxation Treaty (Convenio para evitar la Doble Imposición), which only recognizes federal-level income taxes as eligible for relief under Spanish tax law.

Key Takeaways for American Expats in Spain

- Only U.S. federal income taxes are deductible under Spanish double taxation relief rules. State and local taxes (e.g., California, New York, Florida) are explicitly excluded, as these are generally deductible at the federal level in the U.S. and thus not considered part of the taxable base subject to Spanish relief.

- The burden of proof lies with the taxpayer. To benefit from the deduction, the taxpayer must provide reliable and verifiable evidence of both the amount and nature of the taxes paid abroad. This includes tax assessments, IRS forms, proof of payment, and documentation on the source and allocation of income.

- No legitimate expectation protection (confianza legítima) is granted where the taxpayer relies on previous tax treatments or administrative practices that are not supported by law. This ruling reaffirms the Spanish Tax Agency’s ability to correct earlier positions if they lack a proper legal basis.

- Form and substance both matter. The resolution highlights the importance of precise tax reporting and legal substantiation when claiming foreign tax credits in Spain. Errors in classification or insufficient documentation may lead to significant financial adjustments.

Implications for U.S. Citizens and Residents Living in Spain

At Lullius Partners, we regularly advise high-net-worth individuals and expatriates—particularly U.S. citizens residing in Spain—on complex cross-border tax compliance and international wealth structuring. This ruling serves as a critical reminder of the nuanced and technical nature of claiming foreign tax credits in Spain, especially in the context of bilateral tax treaties.

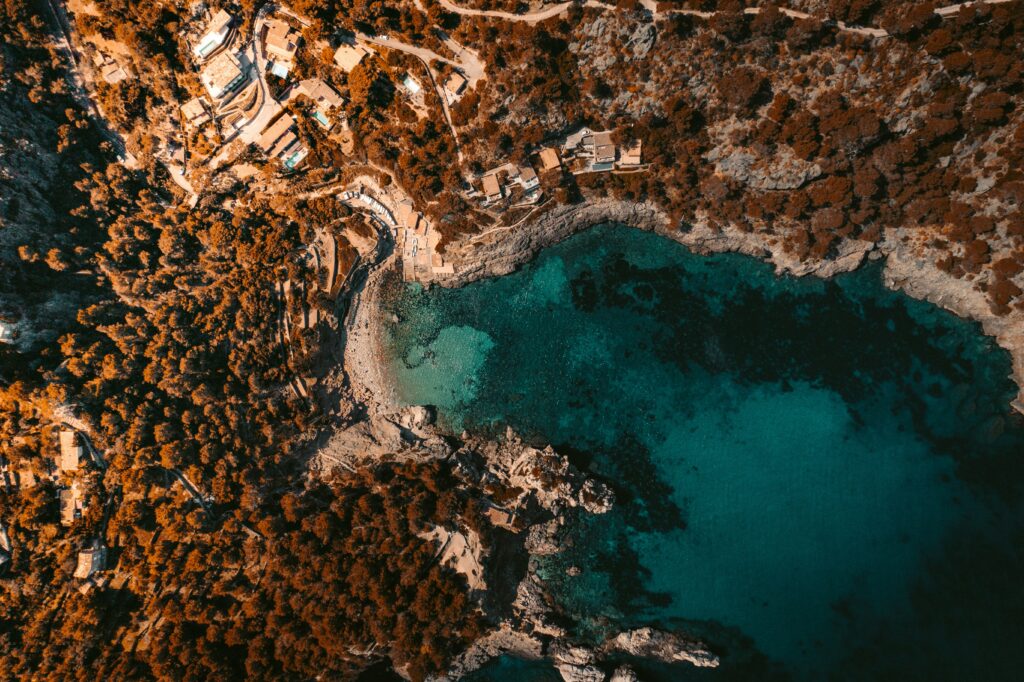

With the Spanish Tax Agency increasingly applying a stricter interpretation of treaty provisions and documentation requirements, it is more important than ever to engage a specialized tax lawyer in Spain or a qualified U.S.-Spain tax advisor. American expats in Mallorca, Madrid or Barcelona must ensure that their income and foreign tax credits are properly structured and documented to avoid potential penalties and denials of relief.

How We Can Help

Lullius Partners is a top-ranked boutique tax law firm in Spain, specializing in tax advisory and litigation, private wealth structuring and international mobility. Our Tax & Private Wealth team assists U.S. citizens with:

- Spanish tax return reviews and optimization (IRPF)

- Double taxation relief analysis under the U.S.-Spain tax treaty

- Representation before Spanish tax authorities and administrative courts

- Cross-border estate and gift planning

- Coordination with U.S. CPAs and wealth advisors

If you are an American living in Spain and need legal and tax clarity on how to manage your U.S. and Spanish tax obligations, our tax lawyers team is here to help.